Our Court of Protection Rates

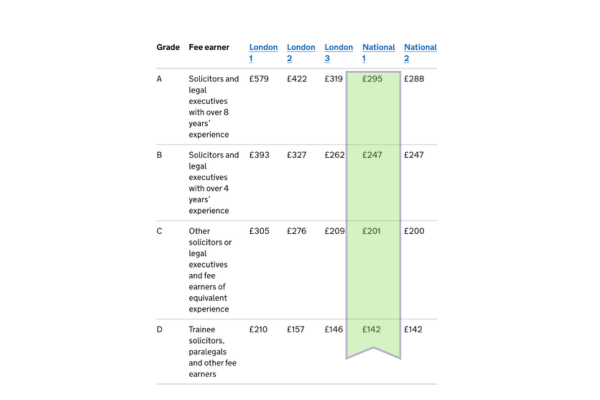

Our Court of Protection rates are set by the government based on the location of the practice. Based in Tunbridge Wells, Kent our rates are National Tier 1, significantly cheaper than London rates – yet we are readily accessible for clients in London and across the South East. Our fees are charged based on the hourly rates of the grade(s) of the team providing the work. Our hourly rates for Court of Protection work are:

Grade A: £295, B: £247, C: £201 and D: £142

These rates are Exclusive of VAT and applicable from 1st January 2026.

Please note: additional fees charged by the Court of Protection themselves may be applicable. See the section titled The Court of Protections’ Own Fees below for details.

A guide to Grades:

Grade A: All partners

Grade B: Senior Associates

Grade C: Trainee Solicitors, Senior Client Administrators, Head of Costs

Grade D: Legal Assistants, Paralegals, Legal PAs, Legal Secretaries, Office Managers, Administrators, Legal Cashiers, Costs Assistants

The Court of Protection’s own Fees (Since 28 April 2025)

In addition to our own fees, the following fees charged by the Court of Protection may be applicable:

Application fee – £421: payable on making an application to start court proceedings or on making an application for permission to start proceedings.

• Appeal fee – £265: payable on filing an appellants notice appealing a court decision or seeking permission to appeal a court decision.

• Hearing fee – £259: payable where the court has held a hearing to decide the application and has made a final order, declaration or decision.

• Copy of document fee – £5: payable on requesting a copy of a document filed during court proceedings.

Our Standard Rates for All Other Work

Hourly Rates

Senior Partners – £395 + VAT (£474 inc VAT)

Partners – £340 + VAT (£408 inc VAT)

Senior Associates – £300 + VAT (£360 inc VAT)

Associates – £250 + VAT (£300 inc VAT)

Senior Paralegals – £225 + VAT (£270 inc VAT)

Trainee Solicitors and Paralegals – £190 + VAT (£228 inc VAT)

Administrative and Junior Paralegals – £140 + VAT (£168 inc VAT)

Wills

Single Will – £495* + VAT (£594* inc VAT)

Mirror Wills – £750* + VAT (£900* inc VAT)

* prices presume simple wills. More complex cases may involve additional work at standard hourly rates

Lasting Power of Attorney (LPA)

Single (Person A) – Property & Finance (PF) OR Health & Welfare (HW): £650** +VAT (£780** inc VAT)

Person A 2 LPAs – PF & HW: £850** + VAT (£1020** inc VAT)

Persons A and B – PF or HW each: £1050** + VAT (£1260** inc VAT)

Persons A & B – PF & HW each: £1350** + VAT (£1620** inc VAT)

Note: The client must pay an additional £92 to the OPG for each LPA

(This price includes storage and certified copies)

** prices presume simple LPAs. More complex cases may involve additional work at standard hourly rates

Probate/Estate Management

With regard to estates where we are asked to deal with the full administration of the estate our hourly rates apply (as set out above under ‘Hourly Rates’). We also offer fixed price grant only applications:

Grant only applications – 4 basic scenarios:

- Application for a grant where there is no inheritance tax to pay and requires completion of IHT205 – £1750 plus VAT (£2100 inc VAT) plus disbursements;

- Application for a grant where there is no inheritance tax to pay and requires completion of IHT205 and IHT217 to claim the transferable nil rate band – £2150 plus VAT (£2580 inc VAT) plus disbursements;

- Application for a grant where there is no inheritance tax to pay and requires completion of IHT400 and associated supplements – £2820 plus VAT (£3384 inc VAT) plus disbursements;

- Application for a grant where the estate is subject to inheritance tax to include completion of IHT400 and associated supplements – £3500 plus VAT (£4200 inc VAT) plus disbursements;

Expert Witness Work

£400 + VAT (£480 inc VAT) – hourly rate for senior partner

£300 + VAT (£360 inc VAT) – hourly rate for partner

All prices subject to change. Correct as of 14/05/2025

Eridge House, 1 Linden Close, Tunbridge Wells, Kent, TN4 8HH

JE Bennett Law is a Limited company incorporated in England and Wales (No.7875908), and is authorised and regulated by the Solicitors Regulation Authority (No.565975). VAT No. 137814893